App installieren

So wird die App in iOS installiert

Folge dem Video um zu sehen, wie unsere Website als Web-App auf dem Startbildschirm installiert werden kann.

Anmerkung: Diese Funktion ist in einigen Browsern möglicherweise nicht verfügbar.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Einkommensteuer

- Ersteller Ulrich

- Erstellt am

Why 47% — or 46% — of Americans pay no income tax

Tuesday, September 18, 2012

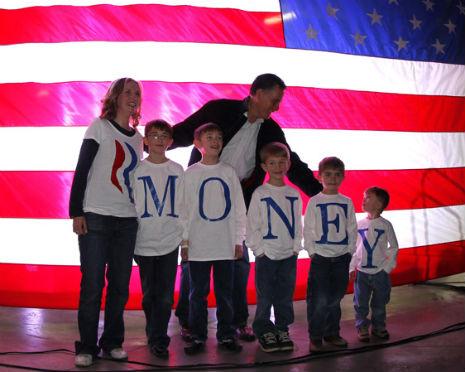

If politics is blood sport, then Republican presidential challenger Mitt Romney just became a gaping wound.

The release by Mother Jones of this video of Romney talking about his fundraising strategy at the Boca Raton, Fla., home of private equity manager Marc Leder is already leading some to predict that it has cost Romney the election.

I’ll leave the political wrangling to the pundits, but what interests me is Romney’s claim about the 47 percent of the people who, as Romney put it, “are dependent upon the government, who believe they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it.”

He’s is referring to those in the country who don’t pay income tax. Now, it may be a stretch to say that all of those who pay no tax are dependent on the government, but the real issue is why so many people pay no tax. Romney implies it’s because they don’t want to take responsibility for themselves, but half the American population can’t be dismissed so easily as freeloaders.

The nonpartisan Tax Policy Center dug into this issue last year, and its findings provide some context. First of all, the number for 2011 is 46 percent (47 percent was for 2010). And of course, this pertains only to those who don’t pay income tax. That doesn’t mean they don’t pay other federal payroll and excise taxes.

As the TPC found:

And what about the other 23 percent? The TPC again:

In other words, the problem is the long-standing practice, favored by both parties, of administering social programs through the tax code. Rather than increase federal spending to pay for all these benefits, Congress chose to create incentives in the tax code. What’s more, many of these tax credits provide even bigger benefits to higher-income households, the TPC found, measured both by dollar value and share of income. That’s part of the reason that so many of these tax benefits stay in place.

In fact, if you include corporations, the U.S. loses about as much each year in tax credits — $1.2 trillion — as it collects in tax revenue, according to the TPC. Most of those benefits, about 60 percent, go to the top income bracket. But the remaining 20 percent are enough to zero-out lower-income earners. All of which makes a strong case for a sweeping overhaul of the tax code.

Romney, of course, wasn’t at a fundraiser to discuss tax policy. But rather than writing off 46 — or 47 percent — of the population as freeloaders, he’d be better off focusing the discussion on tax reforms that would bring many of them back into the tax-paying fold.

Quelle: Houston Chronicle

Tuesday, September 18, 2012

If politics is blood sport, then Republican presidential challenger Mitt Romney just became a gaping wound.

The release by Mother Jones of this video of Romney talking about his fundraising strategy at the Boca Raton, Fla., home of private equity manager Marc Leder is already leading some to predict that it has cost Romney the election.

I’ll leave the political wrangling to the pundits, but what interests me is Romney’s claim about the 47 percent of the people who, as Romney put it, “are dependent upon the government, who believe they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it.”

He’s is referring to those in the country who don’t pay income tax. Now, it may be a stretch to say that all of those who pay no tax are dependent on the government, but the real issue is why so many people pay no tax. Romney implies it’s because they don’t want to take responsibility for themselves, but half the American population can’t be dismissed so easily as freeloaders.

The nonpartisan Tax Policy Center dug into this issue last year, and its findings provide some context. First of all, the number for 2011 is 46 percent (47 percent was for 2010). And of course, this pertains only to those who don’t pay income tax. That doesn’t mean they don’t pay other federal payroll and excise taxes.

As the TPC found:

About half of people who don’t owe income tax are off the rolls not because they take advantage of tax breaks but rather because they have low incomes. For example, a couple with two children earning less than $26,400 will pay no federal income tax this year because their $11,600 standard deduction and four exemptions of $3,700 each reduce their taxable income to zero. The basic structure of the income tax simply exempts subsistence levels of income from tax.

And what about the other 23 percent? The TPC again:

Three-fourths of those households pay no income tax because of provisions that benefit senior citizens and low-income working families with children. Those provisions include the exclusion of some Social Security benefits from taxable income, the tax credit and extra standard deduction for the elderly, and the child, earned income, and childcare tax credits that primarily help low-income workers with children. Extending the example offered above, the couple could earn an additional $19,375 without paying income tax because their pre-credit tax liability of $2,056 would be wiped out by a $2,000 child tax credit and $57 of EITC.

Those provisions matter most for households with income under $50,000, who make up nearly 90 percent of those made nontaxable by tax expenditures. Higher-income households pay no tax because of other provisions. Itemized deductions and credits for children and education are a bigger factor for households with income between $50,000 and $100,000. The relatively few nontaxable households with income over $100,000 benefit most from above-the-line and itemized deductions and reduced tax rates on capital gains and dividends.

In other words, the problem is the long-standing practice, favored by both parties, of administering social programs through the tax code. Rather than increase federal spending to pay for all these benefits, Congress chose to create incentives in the tax code. What’s more, many of these tax credits provide even bigger benefits to higher-income households, the TPC found, measured both by dollar value and share of income. That’s part of the reason that so many of these tax benefits stay in place.

In fact, if you include corporations, the U.S. loses about as much each year in tax credits — $1.2 trillion — as it collects in tax revenue, according to the TPC. Most of those benefits, about 60 percent, go to the top income bracket. But the remaining 20 percent are enough to zero-out lower-income earners. All of which makes a strong case for a sweeping overhaul of the tax code.

Romney, of course, wasn’t at a fundraiser to discuss tax policy. But rather than writing off 46 — or 47 percent — of the population as freeloaders, he’d be better off focusing the discussion on tax reforms that would bring many of them back into the tax-paying fold.

Quelle: Houston Chronicle

Anja1402

Well-Known Member

Ich bin mir da nicht so sicher.. Ich habe gestern ein Gespräch zwischen zwei Handwerkern mitbekommen, die sich nicht etwa darüber aufregen, dass Romney die halbe Nation als Schmarotzer abtut, sondern darüber, dass Sie Steuern zahlen müssen, während 47% keine Steuern zahlen. Das wäre sowieso alles Obamas Schuld. Allerdings wohne ich hier in Republikaner-Land....

Ich finde, wir sollten ihn machen lassen: momentan tritt er von einem Fettnaepfchen ins naechste

Kann mir schwer vorstellen, dass man so eine Praesidentschaftswahl gewinnen kann ....

Der tritt nicht in Fettnaepfchen, sondern der nimmt Anlauf und springt mit angezogenen Beinen hinein.

Ich denke, dass die Wahl trotzdem sehr knapp fuer Obama ausgehen wird, weil der brave Fox Zuschauer diese ganzen Wahrheiten glaubt und so mancher erzkonservative Niedrigverdiener (mit Romney's Wahrnehmung sind das alle, die weniger als $200,000 im Jahr verdienen) gar nicht rafft, dass es auch an sein Geld gehen wird, wenn Romney und sein Vizehansel an die Macht kommen.

Ich kenne einige im meinem etwas entfernteren Umfeld und zwei im naeheren, die Romney waehlen werden. Das sind zum Teil richtig arme Schlucker und man sollte meinen, dass Frauen und andere Minderheiten sich eher von ihm abwenden. Nein, gerade diese wollen ihn waehlen...Selbst meine ehemalige Arbeitskollegin, die Dank fehlender Krankenversicherung nun eine auf Lebenszeit ruinierte Gesundheit hat, wird ihn waehlen. Und alles nur, weil Obama den Sozialismus bringen wird ;-) und bisher konnte mir keiner dieser ueberzeugten Waehler den Sozialismus erklaeren. Ganz begeistert war ich ja, dass einige befuerchten, dass Obama aufgrund seiner Aeusserung bzgl. Kindern von illegalen Einwanderen und deren Aufenthalt hier drueben, deren Stimmen (der illegalen Einwanderern wohlgemerkt) bei der Wahl bekommen wird.

Laut Chuck Norris wird uebrigens auf Tausende von Jahren die Dunkelheit ueber Amerika hereinbrechen, wenn Obama wieder gewaehlt wird. Der hat sich da sicherlich bei seinem Kampfsport auch die ein und andere irreperable Schaedigung am Hirn zugezogen.

Ob der in vier Jahren auch einen leeren Stuhl vollsuelzen wird? ;-)

Ich bin mir da nicht so sicher.. Ich habe gestern ein Gespräch zwischen zwei Handwerkern mitbekommen, die sich nicht etwa darüber aufregen, dass Romney die halbe Nation als Schmarotzer abtut, sondern darüber, dass Sie Steuern zahlen müssen, während 47% keine Steuern zahlen. Das wäre sowieso alles Obamas Schuld. Allerdings wohne ich hier in Republikaner-Land....

Eben...ich hocke hier in NC. Die haben ja auch alle uebereifrig fuer Amendment 1 gestimmt (nur Ehe zwischen Mann und Frau ist legal). Die waehlen auch einen Mormonen ins Weisse Haus, solange das Geschlecht der 10+ Ehepartner stimmt. ;-)

Wie ich heute gelernt habe, ist "ein Romney" in Deutschland inzwischen die neue wissenschaftliche Maßeinheit für die kürzeste Entfernung zwischen zwei Fettnäpfchen. Physiker, man muss sie einfach lieben.Ich finde, wir sollten ihn machen lassen: momentan tritt er von einem Fettnaepfchen ins naechste

Wie ich heute gelernt habe, ist "ein Romney" in Deutschland inzwischen die neue wissenschaftliche Maßeinheit für die kürzeste Entfernung zwischen zwei Fettnäpfchen. Physiker, man muss sie einfach lieben.

Wie geil!

Das muss ich gleich mal klauen

Das muss ich gleich mal klauen